Business houses or Families that manage substantial amounts of wealth are always in need of financial advice and legal aid. We work with Tax and Legal Experts to ensure all procedures and processes flow smoothly.

Our Family office Service mainly looks at 4 areas which broadly includes the following sub-services

COMPLIANCE SERVICES

Legal Advisory, Wealth Structuring, Legal verification of Physical Assets and Support on Litigation issues.

MANAGEMENT WEALTH

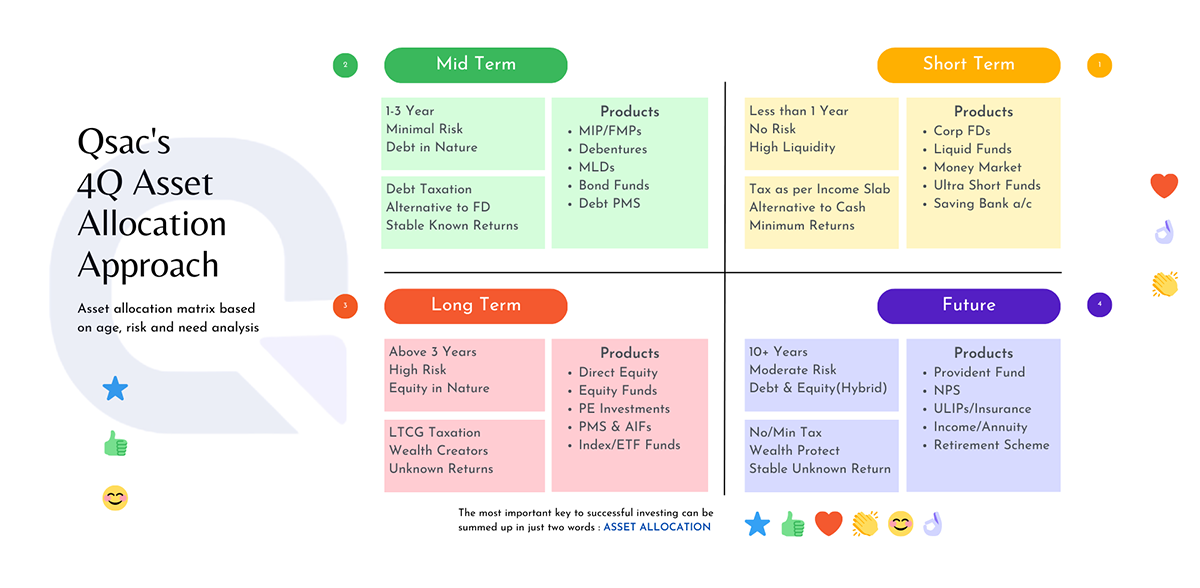

Our Services include Risk Management, Asset Allocation, Investment Advisory and Cash Flow planning.

REPORTING AND CONTROLLING

Accounting & Reporting, Tax Filing & Tax Records maintenance and managing and Tracking of Investment.

ESTATE PLANNING

Our Services include Will Creation, Estate Planning, Registration of Trust, and Executor Services for distribution of assets."